Best Prepaid Credit Card For Small Businesses

As a blogger, making money online is not as easy as some people may think. Unfortunately, this also applies to young entrepreneurs and small business owners.

In fact, it’s even sometimes really difficult for small businesses and young entrepreneurs to make money nowadays.

However, it’s not just about making money; it’s also about managing one’s finance, which is really hard to do sometimes.

SEE ALSO: How To Easily Manage Your Credit Cards Finance

This is why one has to be more creatively frugal and a little bit flexible with money nowadays. This is where prepaid credit cards could really be the help you need to be able to manage your spending.

What’s a prepaid credit card?

Table of Contents

So what is a prepaid credit card and why do I think you need to get it? A prepaid credit card is a kind of financial arrangement that allows you to only spend the money you have. The best thing about this pay-as-you-go credit card is the flexibility it offers.

This is the kind of money management facility that lets you prioritize your spending. With this kind of card, you don’t need to worry too much about being in debt.

Unlike the traditional credit card where you are expected to pay back with the interest, the prepaid card means you are spending your own money.

Also, your prepaid credit card can be used in a lot of places just like the normal credit or debit cards issued by your banks.

This is the card you should get if you don’t want to get into debt, and you truly want to easily manage your finance.

SEE ALSO: Best Ways To Manage Your Credit Cards Finance

In most cases, some card providers will charge you a small administration fee while others charge for the transaction and withdrawal fee each time you use the ATM. However, there is always an option for you.

Just make sure you check and read the terms and conditions before signing up. Below are some of the best-prepaid card providers for small businesses and young entrepreneurs in the UK:

#1]. Pockit Prepaid Credit Card

- Up to 3 additional cardholders

- £0.99 one-off payment

- ATM withdrawals cost £0.99

- Paypoint topup costs £0.99

- You can pay for a card by SMS

- Your card arrives in 1-3 days

- Up to 10% cashback

#2]. Cashplus Prepaid Credit Card

- Up to £250 overdraft facility

- £5.95 admin fee, then £9.95 a month

- Free UK transaction & ATM withdrawals

- Get almost instant approval, no credit check

- Free loading charge from debit card & Post Office

#3]. iCount Prepaid Credit Card

- Free UK transaction & £0.50 ATM withdrawals

- £4.95 admin charge, then £9.95 monthly

- Get almost instant approval, no credit check

- Up to 3 additional cardholders

- Free Post Office loading charge, £3.00 Epay

- Improve your credit score with CreditBuilder™

- Account Number and Sort Code to accept payment

#4]. Virgin Money Prepaid Credit Card

- Sign up for an award-winning prepaid card

- Choose ‘Pay as you go’ or ‘Pay monthly’ (£4.75 per month)

- Safer than cash, acceptable anywhere there’s MasterCard sign

- Great discounts at Virgin companies

- Your MasterCard® will arrive in 1-3 days

- Up to 10% cashback with top UK retailers

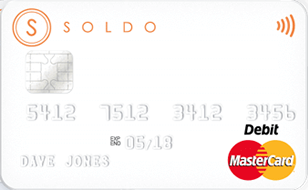

#5]. Soldo Prepaid Credit Card

- No admin fees for 3 months, then £2 a month

- Free UK transaction & £0.50 ATM withdrawals

- Free bank transfer loading, £1 charge from debit card

pRefMB Wow! This could be one particular of the most useful blogs We have ever arrive across on this subject. Actually Great. I am also a specialist in this topic so I can understand your effort.